Accounting Purposes

The JK Subsidy receipt is a reimbursement for expenses incurred by the employer within each month.

Accordingly, to meet the “matching” principle of accounting and for the businesses reports to make sense, the correct bookkeeping requires recognition of the subsidy in the same period as the related expenses are incurred.

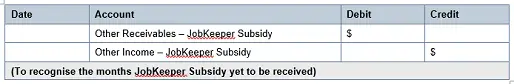

Therefore, strictly speaking each month a journal to recognise the “Receivable” should be brought in. For many businesses this is unnecessary for most months except for 30th June. In order for the financial reports to be reviewed accurately, correct bookkeeping for 30th June:

It is best to recognize the receivable as “Other Receivables” to ensure it is not misread as an amount owed by clients of the business.

It is best to recognize the income as “Other Income” or as what would be a negative expense account (ie as a separate account below the relevant wages expense accounts).

This Journal would then be reversed in July.

Advise the Accountant that you have brought in the yet to be received amount so that the reports are aligned.

Tax Purposes

JobKeeper Subsidy receipts are assessable income to the employer. This is due to it being a reimbursement of wages that are tax deductible.

The ATO website states their view that the amount of the JobKeeper subsidy is not Assessable until the period in which it is received, whether the business reports income tax on an Accrual Basis or a Cash Basis.

Quote:

Operating on an accruals basis

· For a business entity which operates on an accruals accounting basis, JobKeeper payments will be derived when the entity provides a valid completed business monthly declaration to us.

· This means that JobKeeper payments for fortnights ending in June will generally be derived in July (or a later month) and will be assessable in the 2020–21 income year.

Operating on a cash accounting basis

· For a business entity which operates on a cash accounting basis, the payments for a JobKeeper fortnight are derived when the entity receives those payments.

· For JobKeeper fortnights ending in June, those payments will be made in July (or later), following receipt of the entity’s business monthly declaration, and will be assessable in the 2020–21 income year.

Accruals: Assessable when you submit the monthly claim form (between the 1st and 14th inclusive of the following month)

Cash: Assessable when received.

Accordingly there will be a timing impact for employers who will receive a tax deduction in the 19/20 tax year for potentially increased wages paid (including the top up amounts) yet the subsidy will not be assessed until the 20/21 tax return.

Eligible Business Participants (EBPs)

EBPs may be receiving payment of JobKeeper subsidy amounts for one person who is, the sole trader, one of the partners in a partnership, one working (non-employee) director or one (non-employee) beneficiary in a trust.

The entity receives the subsidy amount as “Other Income”. It is also assessable income to the Business when it is received.

Noting that the business is NOT required to have paid amounts to the EBP.

As there is no expense to match, we do not believe it is required to bring in the “Receivable” for EBP payments.

Previous Newsletter Articles

Business Tips

HR Information

Contact Us

1300 022 270

enquiries@myabbs.com.au