Review Assets Bought and Sold

Fixed assets are commonly known as property, plant and equipment and is an accounting term for assets that cannot be easily converted into cash. Therefore, the allocation of assets is important to ensure the asset is flagged for review by the accountant to either expense the asset (depending on the value of the asset and threshold of the day) or depreciate the asset over a period of time or life of the asset.

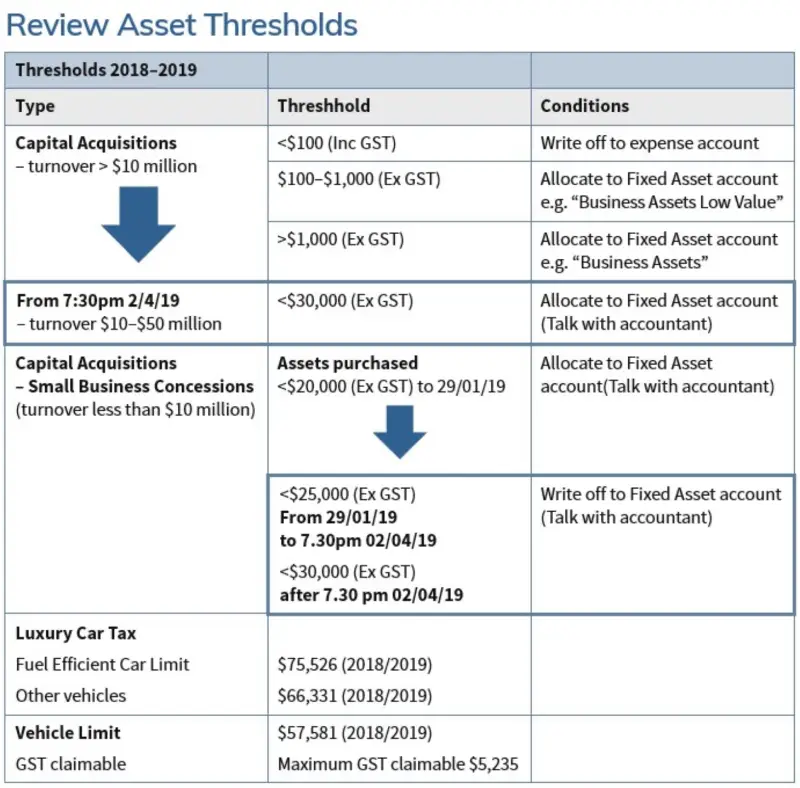

ICB recommends seeking the accountant’s advice on how they wish assets less than the threshold (see below table) are to be allocated to ensure profitability of the business is not distorted.

Allocation of Assets

With the new instant asset write off laws that the ATO has released it is recommended that you still enter these big capital items into the capital area on the balance sheet. The accountant then will make the determination at the end of the year to either write off to expense or capitalise depending on where the business is sitting financially.

Alternatively, you could request in writing at time of purchase where the accountant would like you to code the items and then follow their instructions.

Previous Newsletter Articles

Business Tips

HR Information

Contact Us

1300 022 270

enquiries@myabbs.com.au